$169.00

$135.20

More Plans

Free Module Updates

One-Click Upgrade

Access To Premium Offers

Multi-Level Tech Support

10 Days Money Back Guarantee

Development licence available for 30 Days on demand

$599.00

$479.20

More Plans

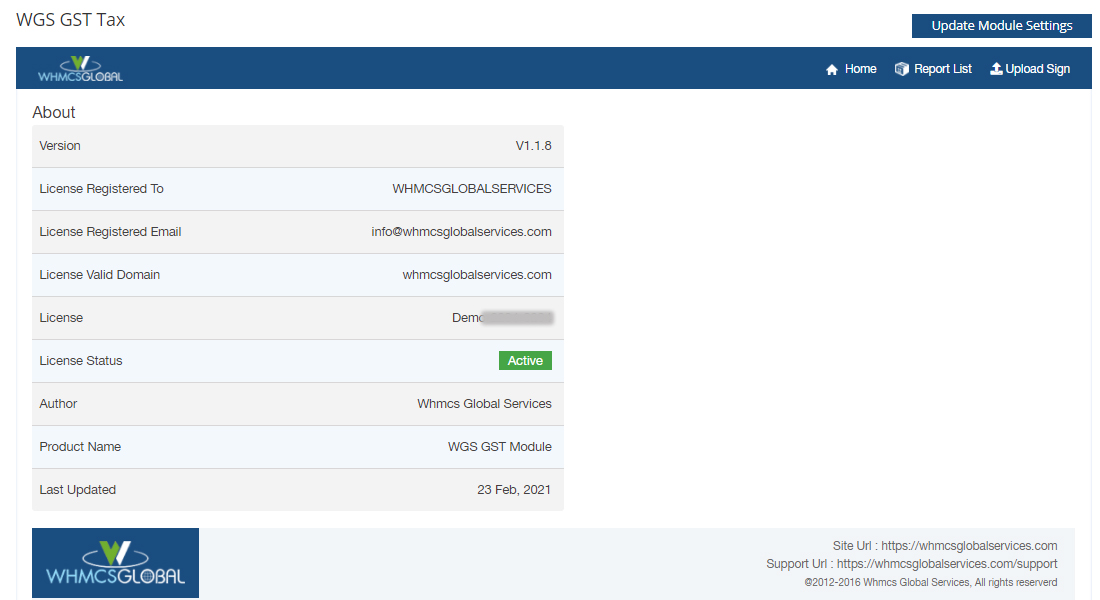

WHMCS GST Module Overview

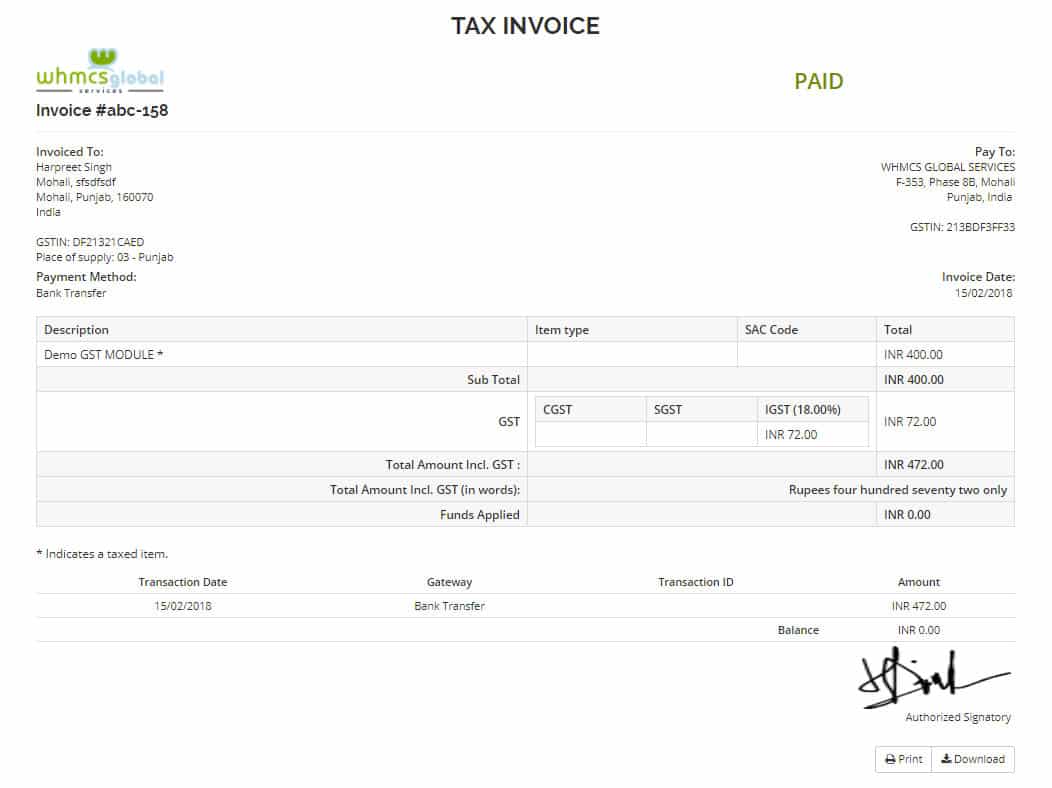

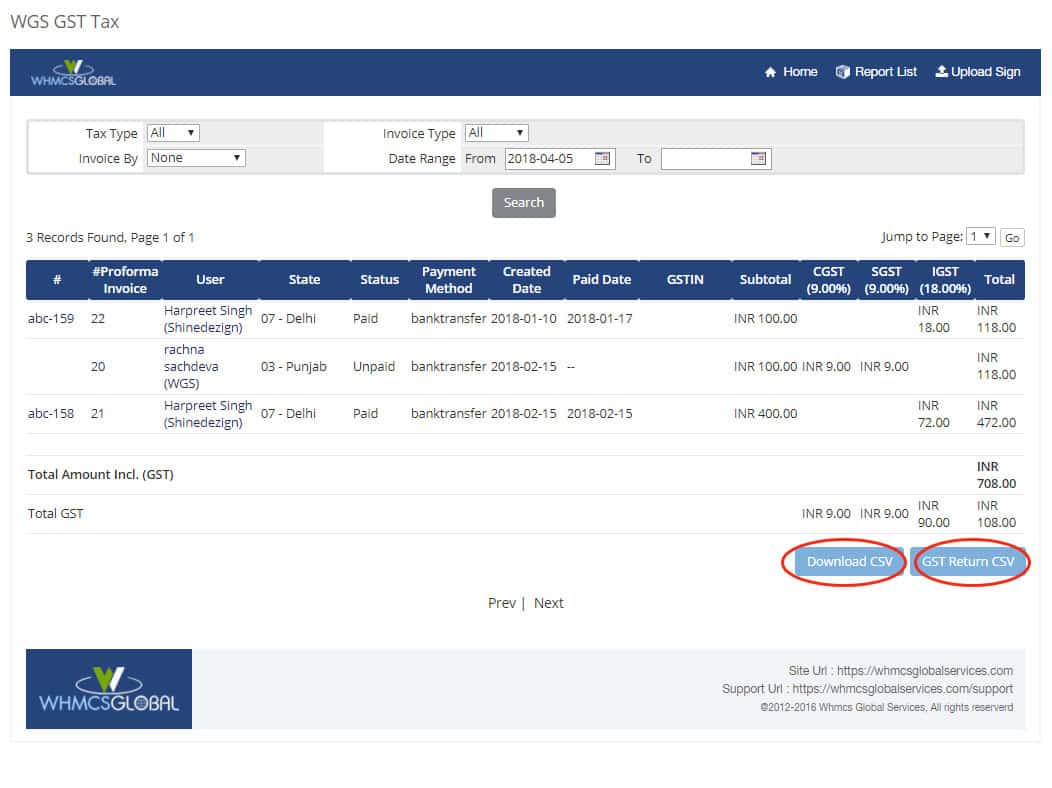

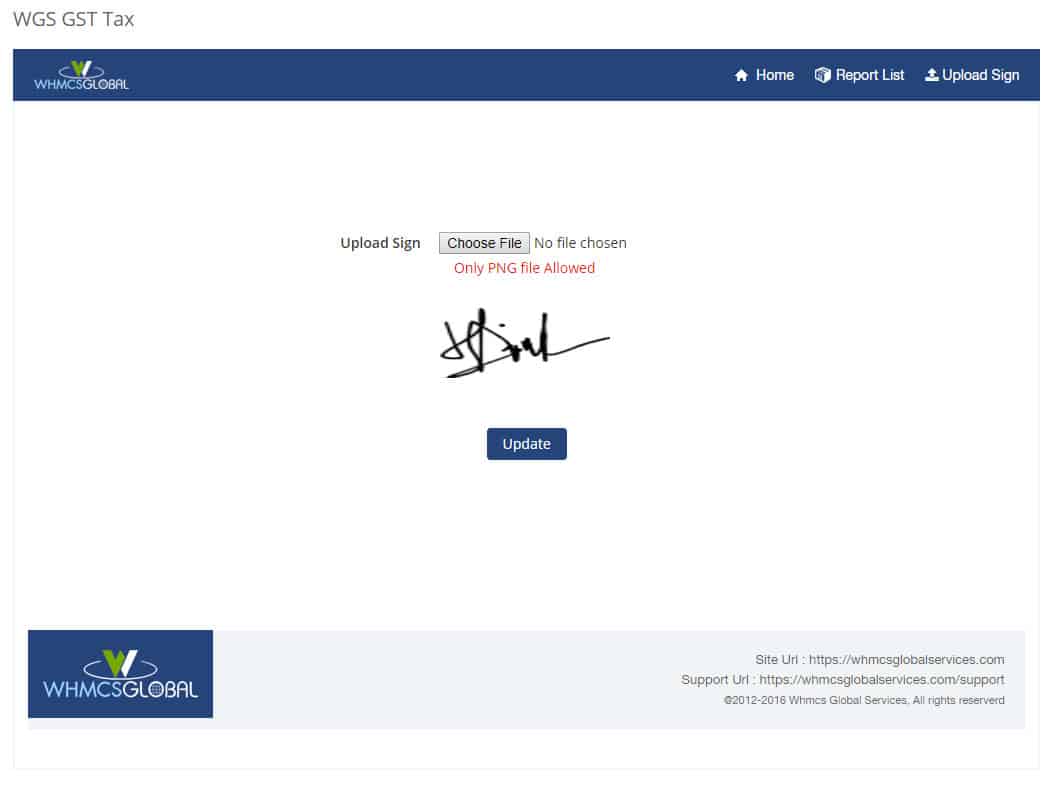

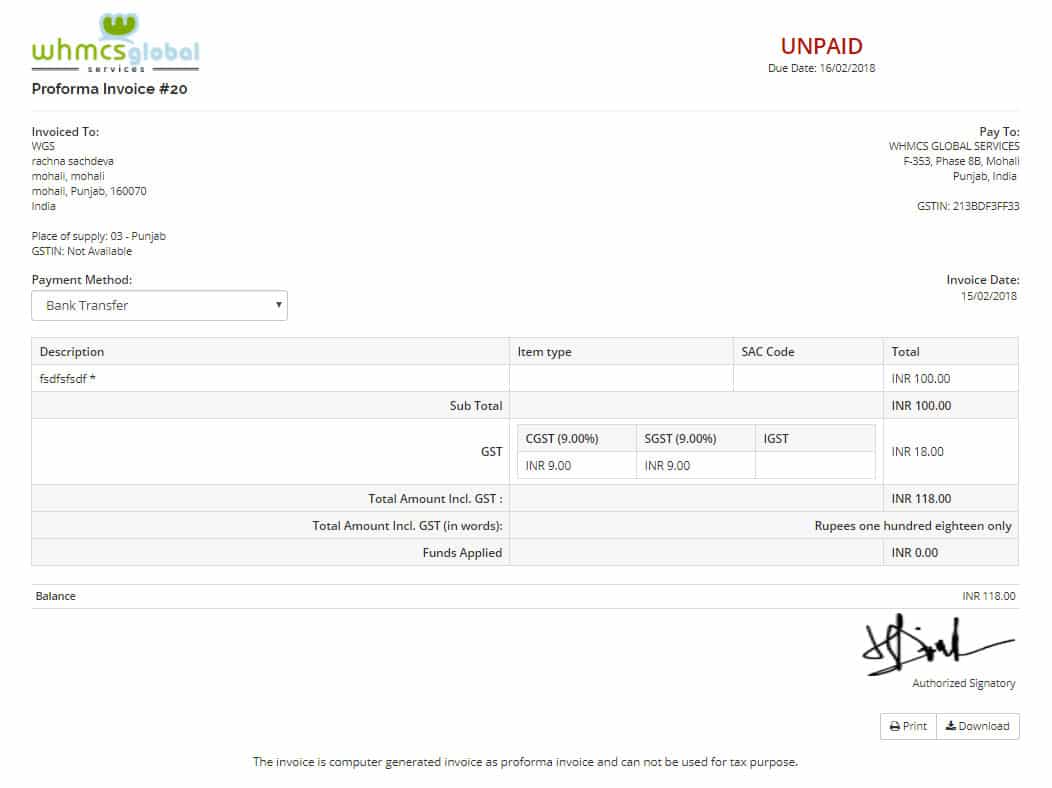

As we all know, GST was launched in India and replaced all previous taxes (like VAT, etc.). Many business owners need help integrating GST with their online store or website. This WHMCS GST module helps WHMCS users to overcome the initial problems that arise while paying GST bills. WHMCS does provide tax rules options where you can configure your GST tax. Our GST gateway module has some additional features that make it stand out.

Basic GST Feature List

Pro GST Module Features

Only for GST Pro module

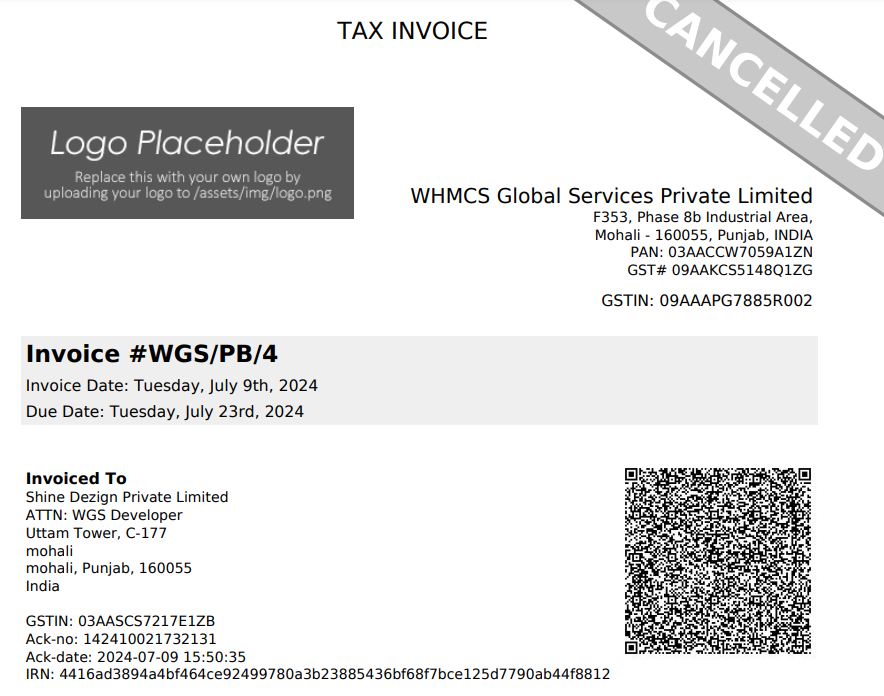

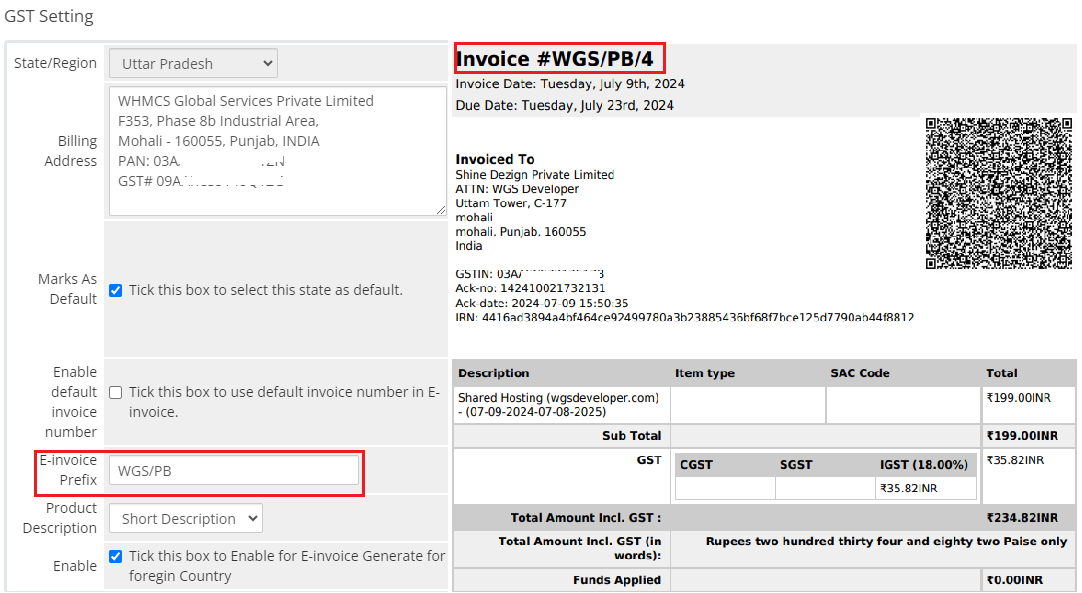

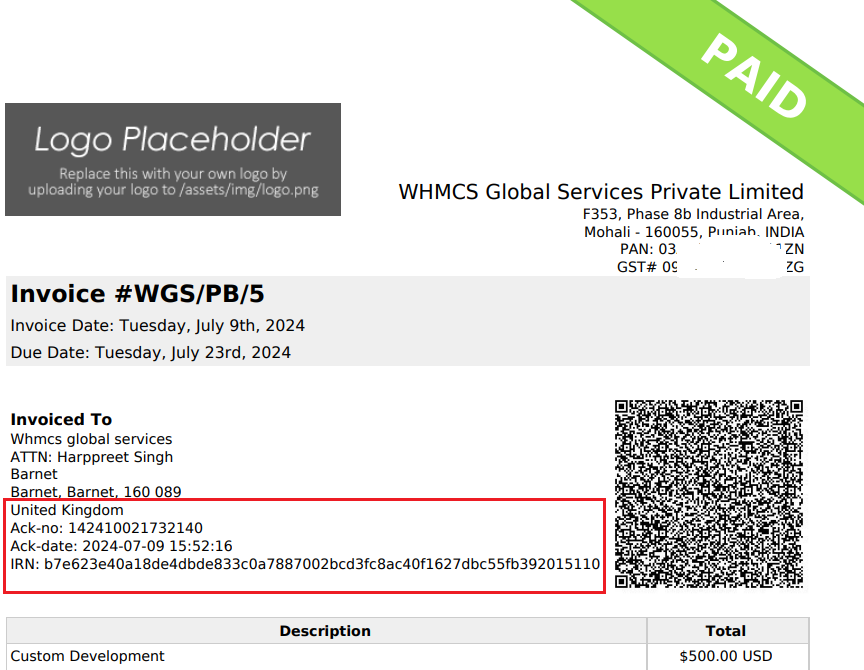

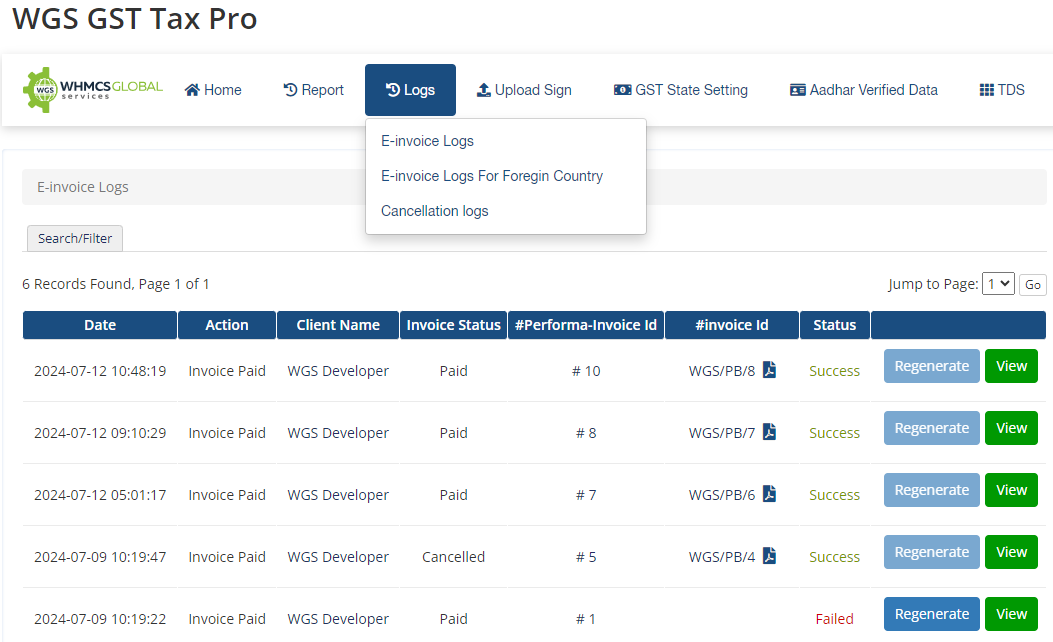

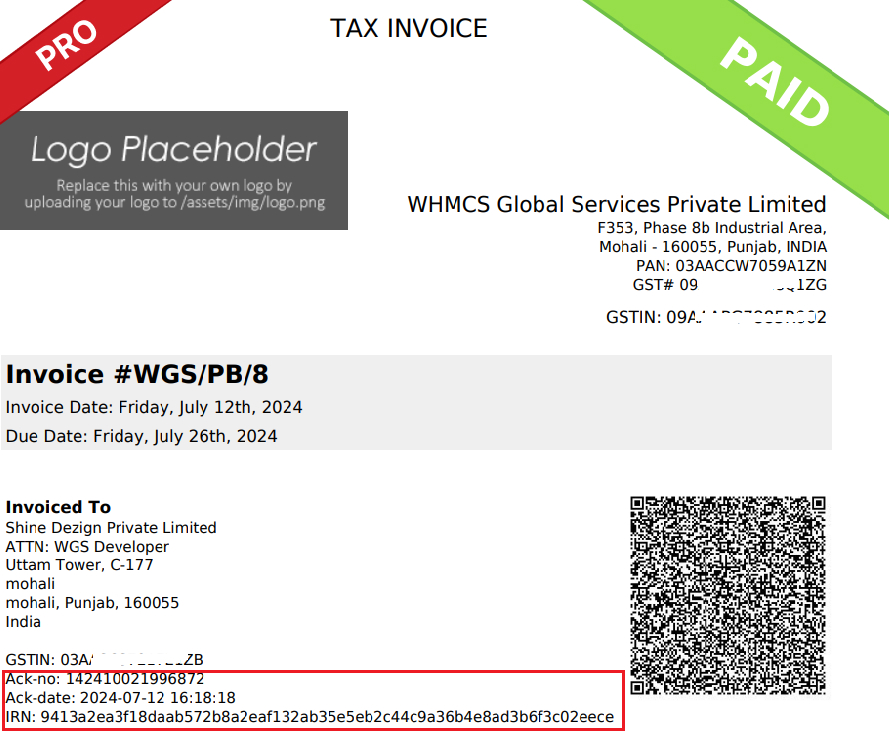

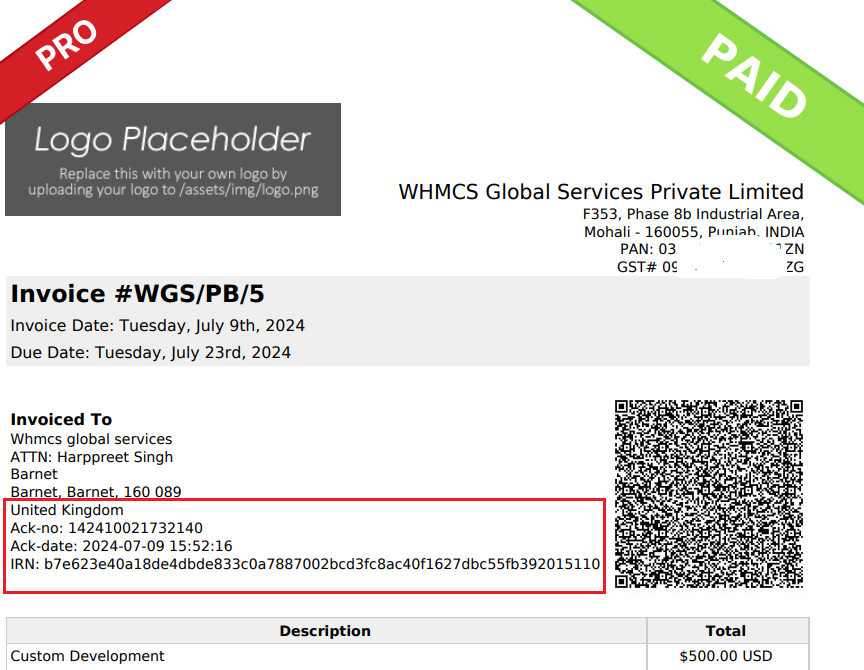

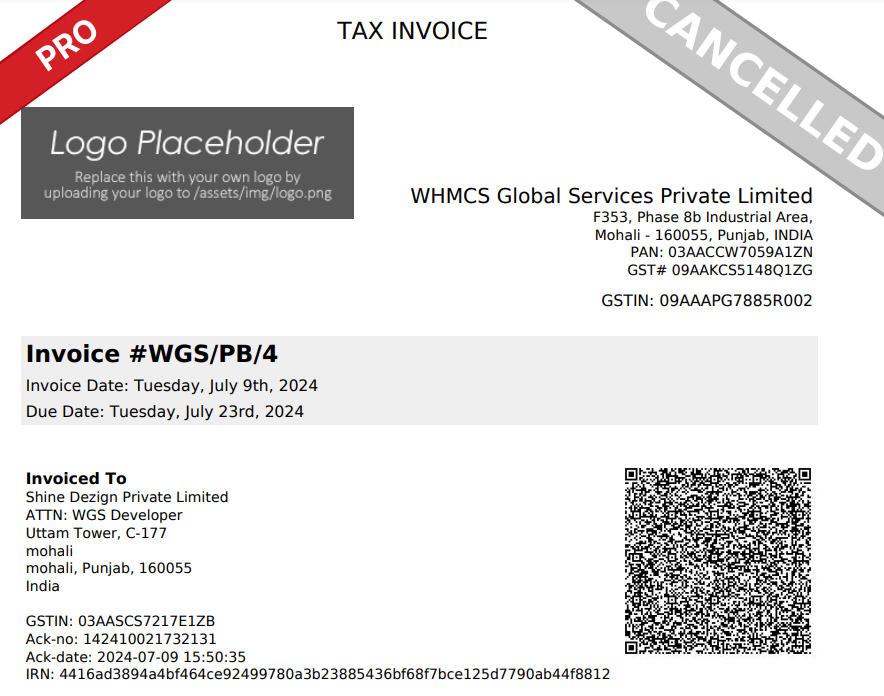

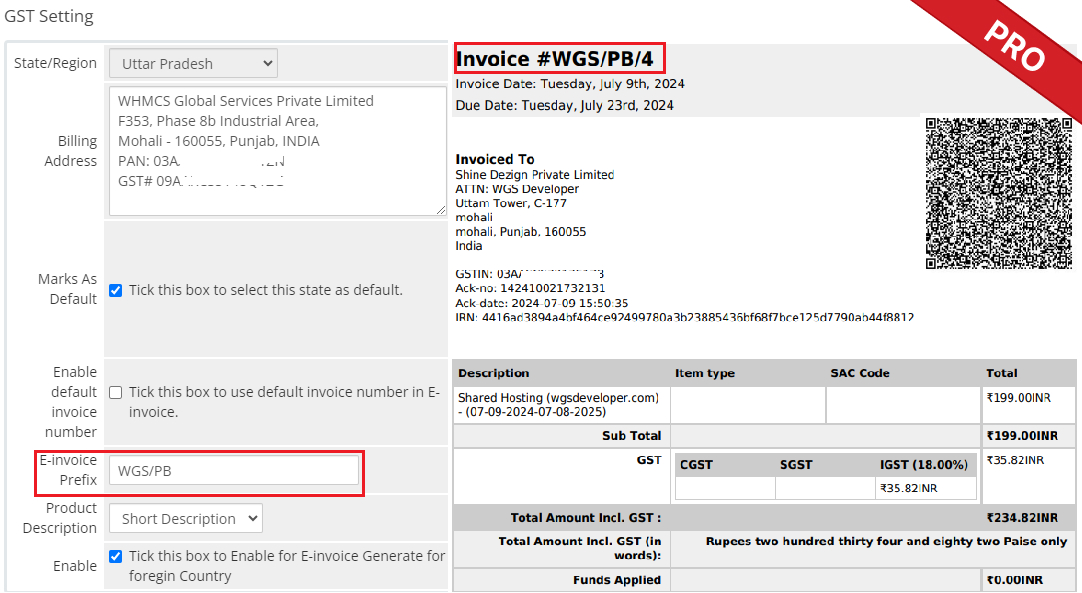

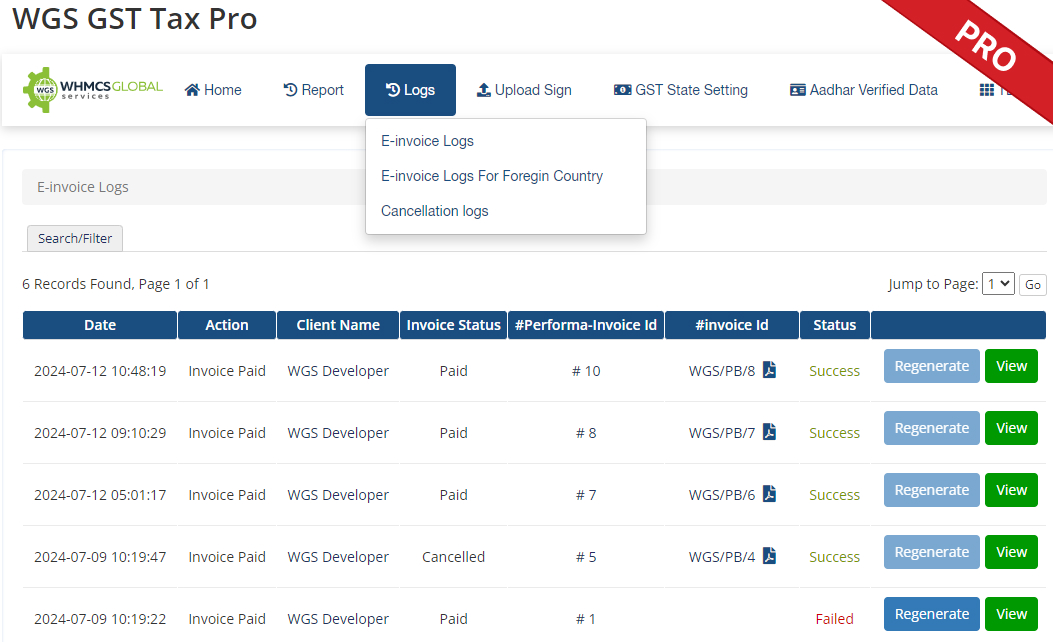

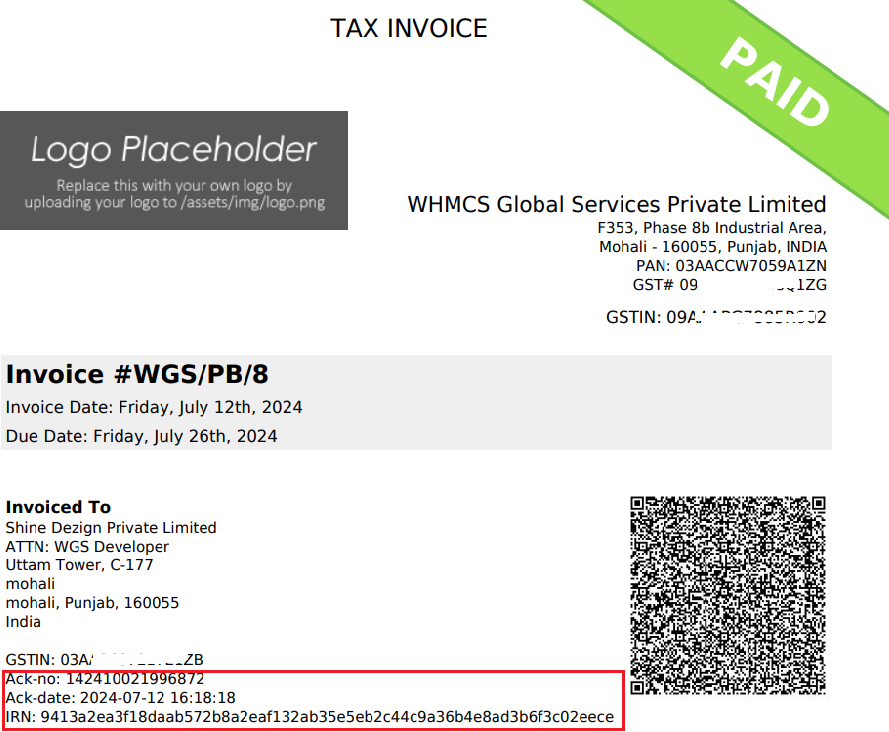

Auto E-invoice (IRN) Generation

Our module smoothly automates the generation of e-invoices for B2B clients on the Government GST portal upon invoice payments in your WHMCS. This reduces the requirement for manual processes, ensuring compliance and efficiency easily.

Choose the Right Plan for your Website

- 1 year of updates & support

- License for 1 domain

- Encoded Version

- 1 year of updates & support

- Multiple Domains

- No License check

- Open Source Version

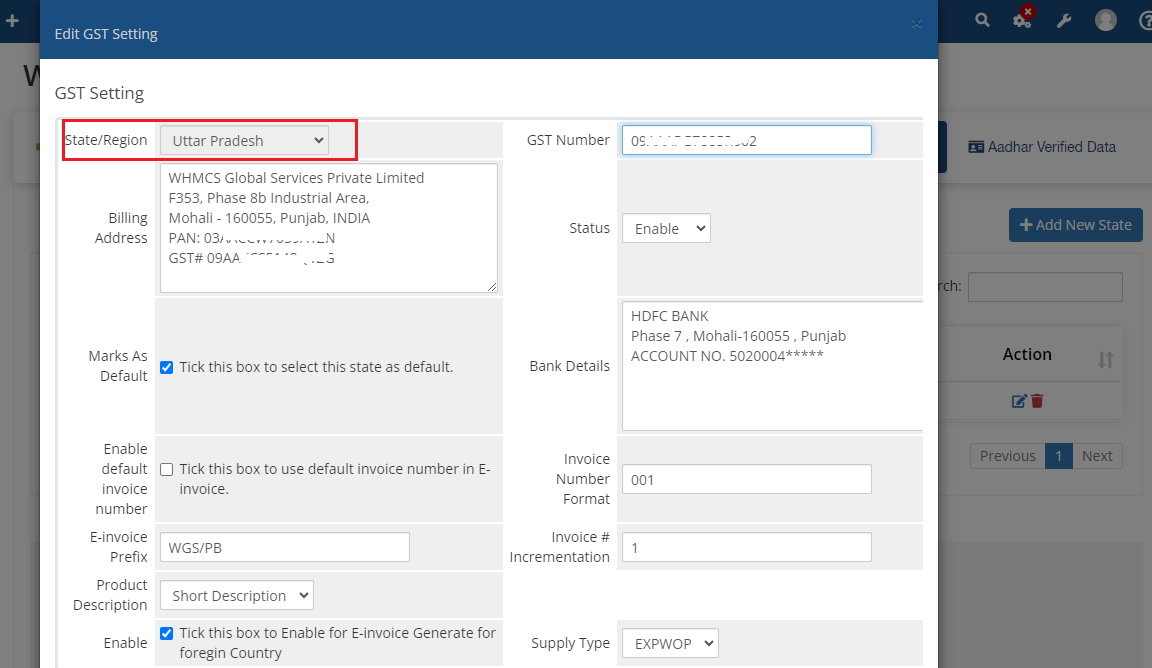

- Auto E-invoice (IRN) Generation

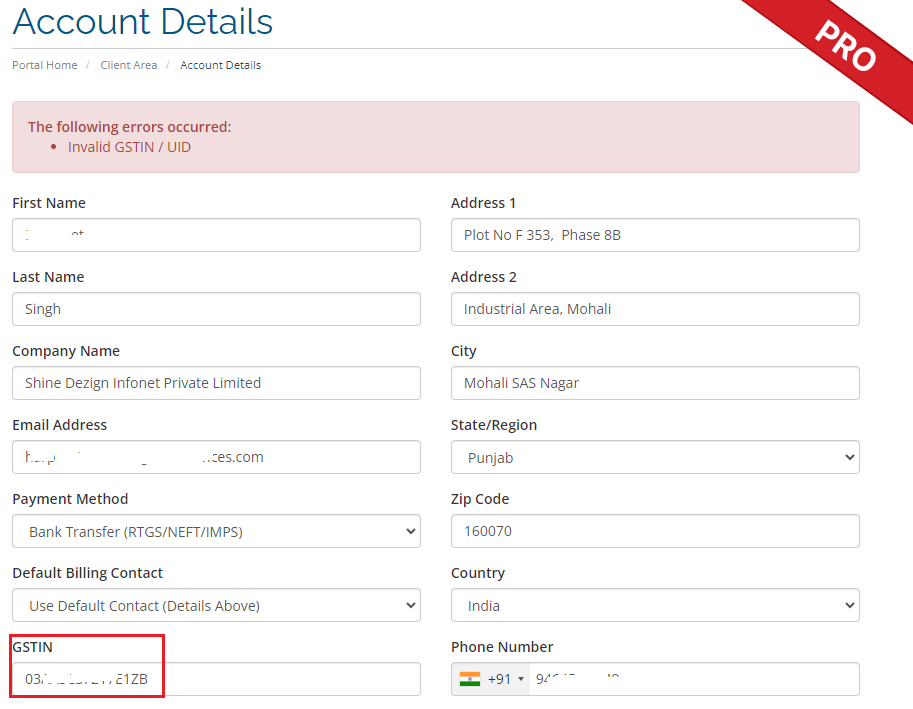

- GST Number Verification

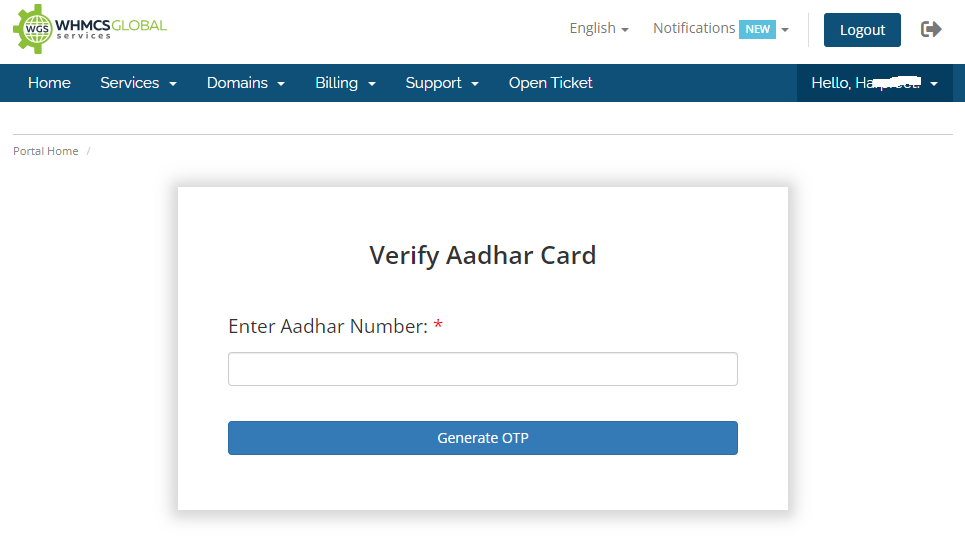

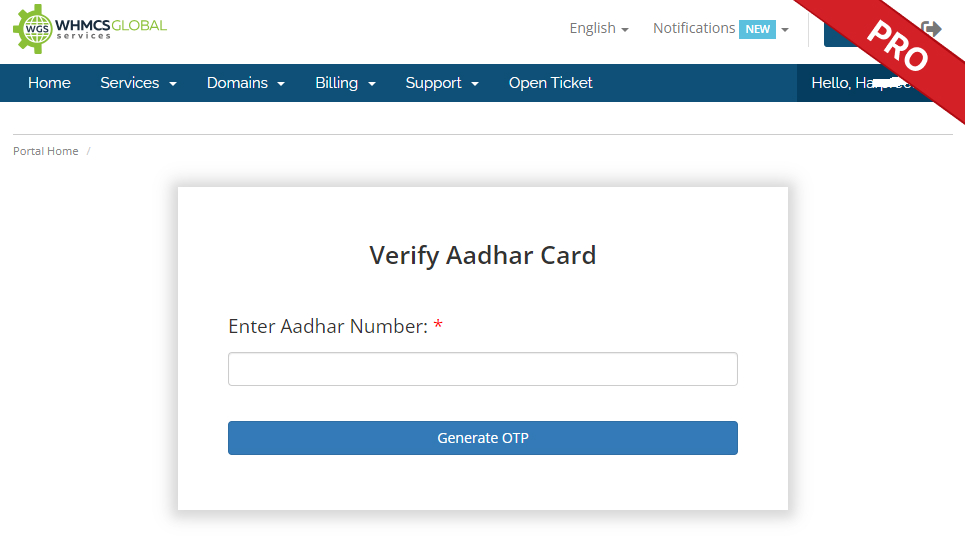

- Aadhar card verification

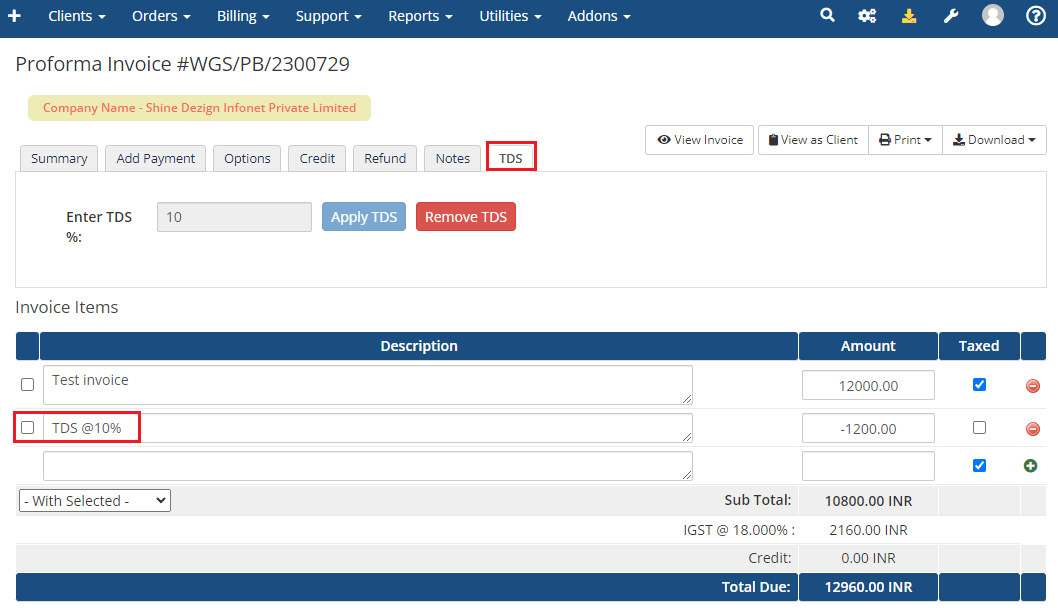

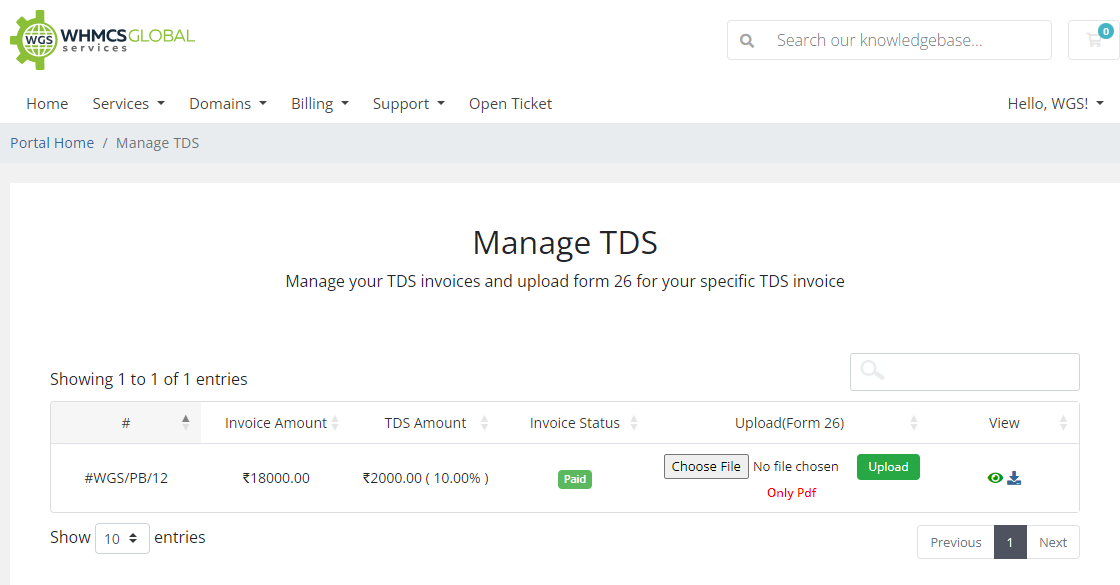

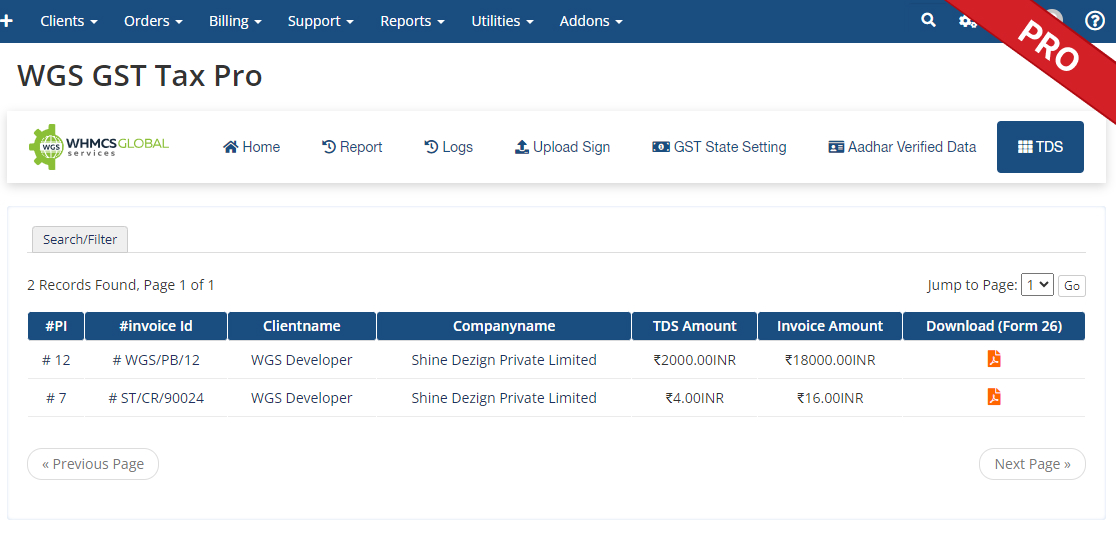

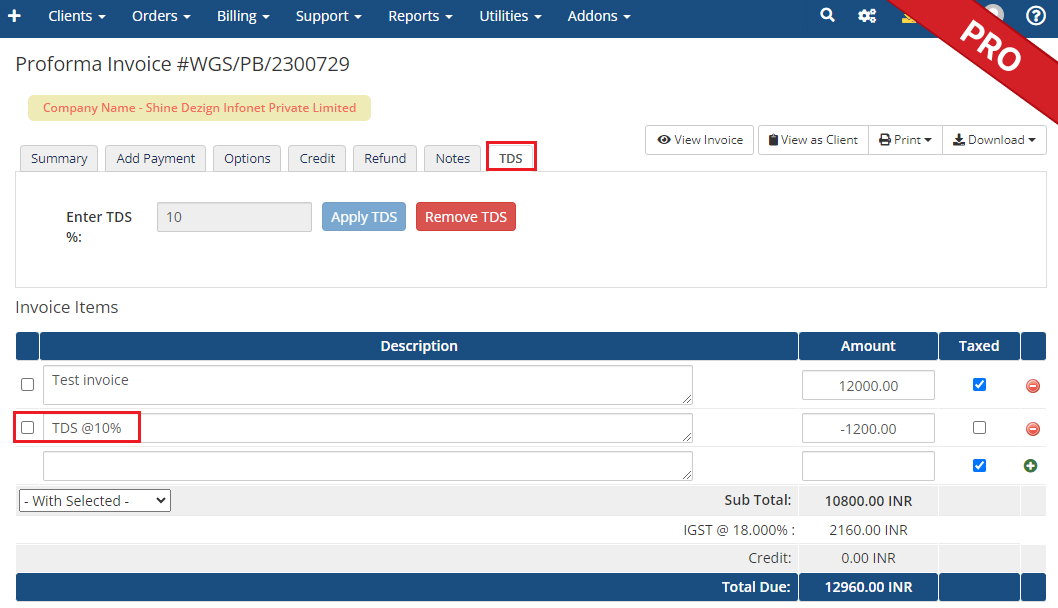

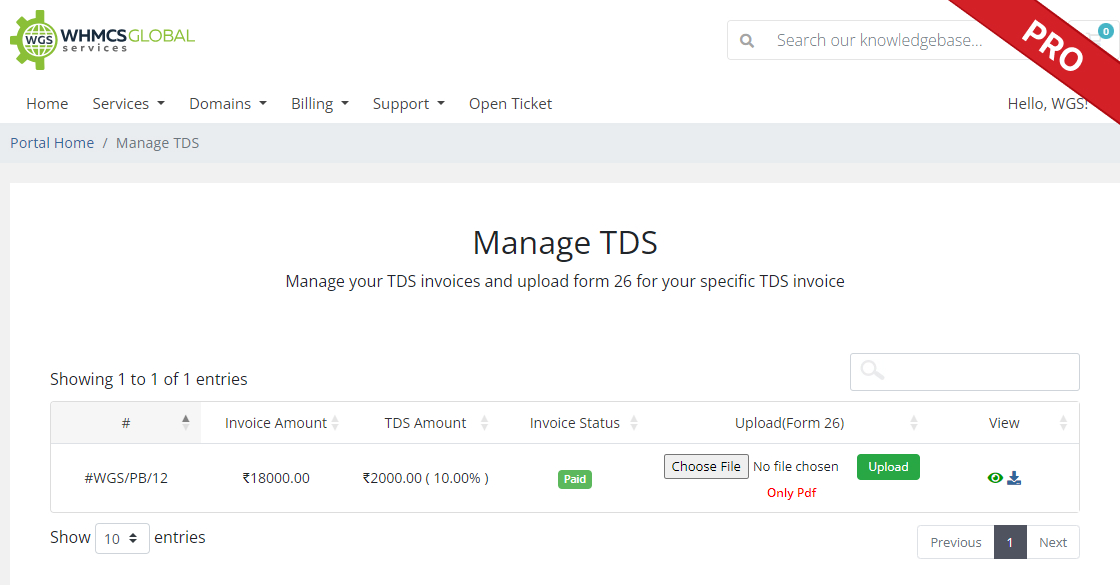

- Manage TDS

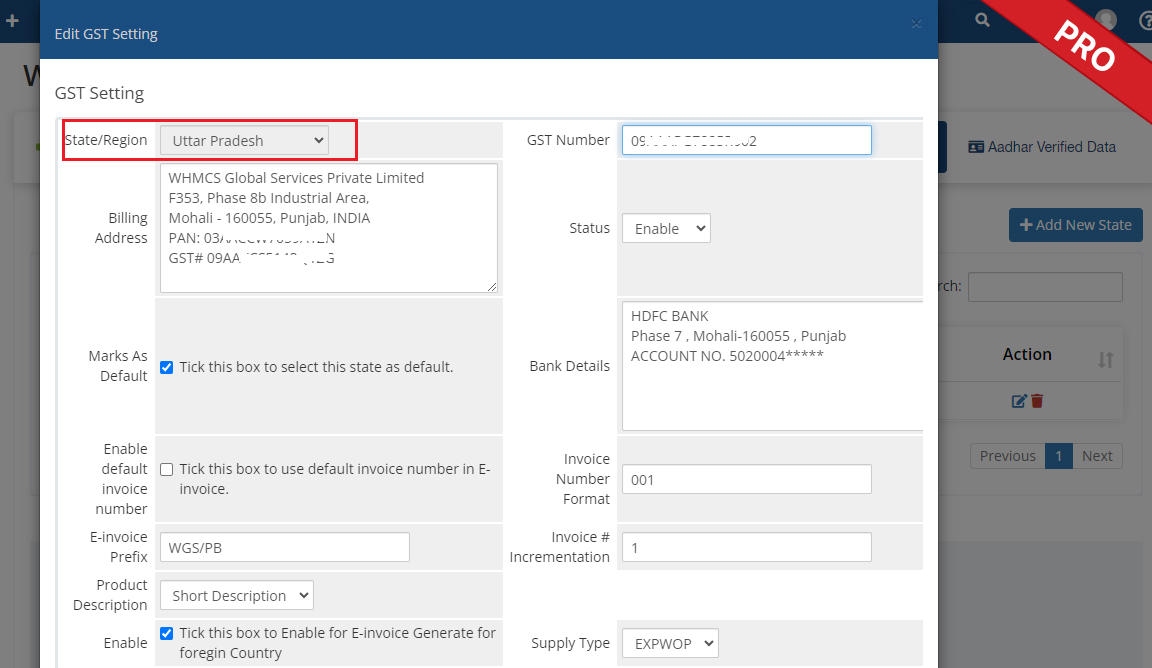

- Supported Multi Business Locations

Your questions, our answers

A WHMCS GST module is a plugin or extension that is designed to help businesses manage GST compliance in their WHMCS installation. It may provide features such as automatic tax calculation, invoice generation, and reporting.

Whether or not you need to use a WHMCS GST module will depend on the tax laws in your country and your business needs. If you need to charge GST on your services, a WHMCS GST module can help simplify the process and ensure compliance.

Yes, most WHMCS GST modules will allow you to customize your tax settings to suit your business needs. This may include setting different tax rates for other products or services, applying tax exemptions, etc. Consult the module documentation or contact the developer for more information.

GST PRO module integrates third-party E-invoicing API to create invoices. But before that, you can sign up for the API here: https://www.mastersindia.co/.

Creating E-invoicing is a paid service, with charges applied per API call. For detailed pricing information, you can connect to the website: https://www.mastersindia.co/

Yes, the module is integrated with this provider API: https://appyflow.in/verify-gst/. You can easily sign up with them, and you can also discuss pricing per verification request.

Yes, Our GST Pro module integrates with API provider https://cyrusrecharge.in/recharge-overview.html. All you need to do is sign up with them, and you can check pricing per verification request on their website.