Free Module Updates

One-Click Upgrade

Access To Premium Offers

Multi-Level Tech Support

10 Days Money Back Guarantee

Development licence available for 30 Days on demand

$230.00

$184.00

Order now

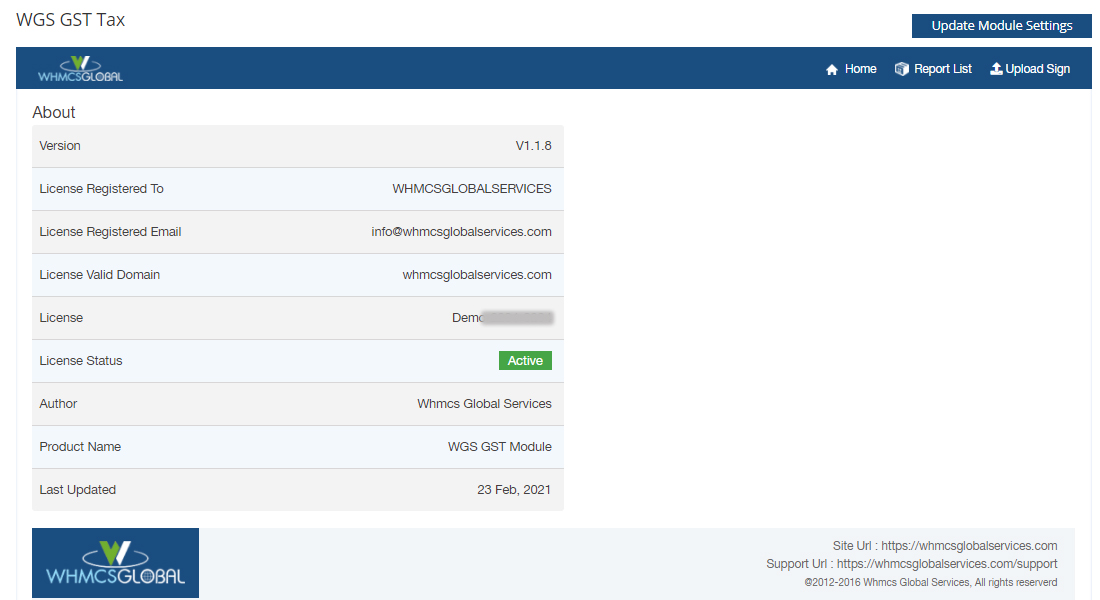

WHMCS GST Module Overview

As we all know, GST was launched in India and replaced all previous taxes (like VAT, etc.). Many business owners need help integrating GST with their online store or website. This WHMCS GST module helps WHMCS users to overcome the initial problems that arise while paying GST bills. WHMCS does provide tax rules options where you can configure your GST tax. Our GST gateway module has some additional features that make it stand out.

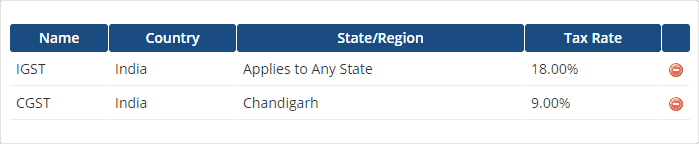

Automatic set up of GST rules

All the tax rules and custom fields that are required for GST will be automatically set up with the help of our module.

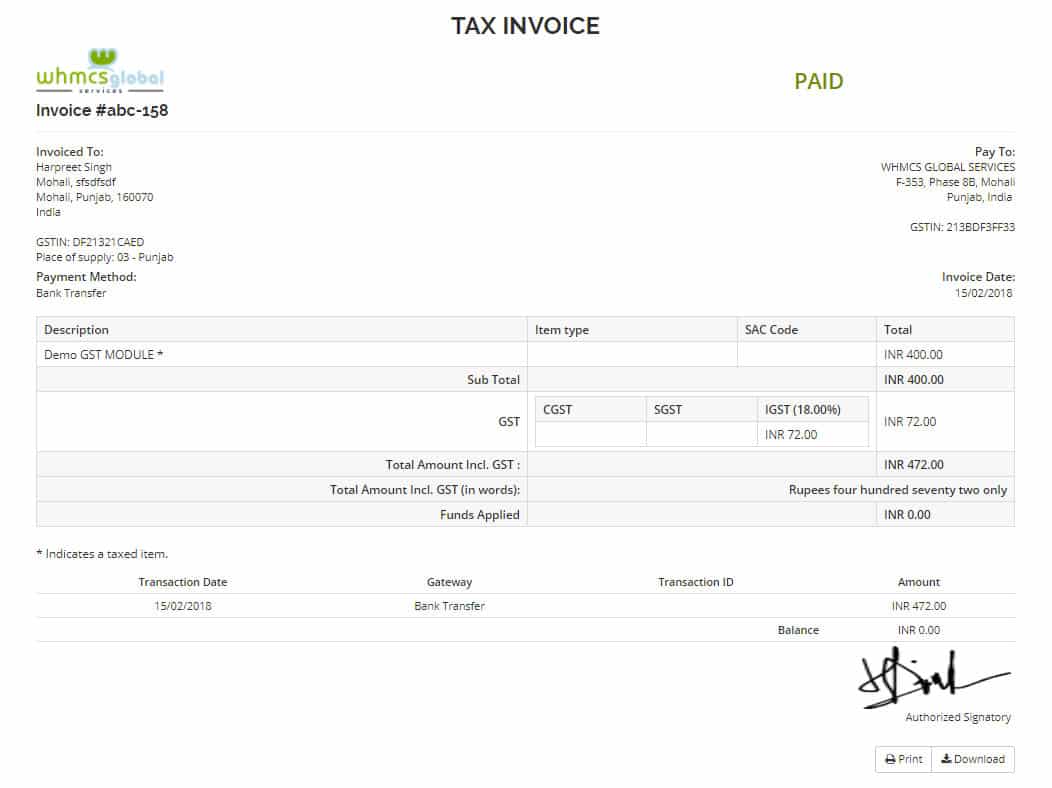

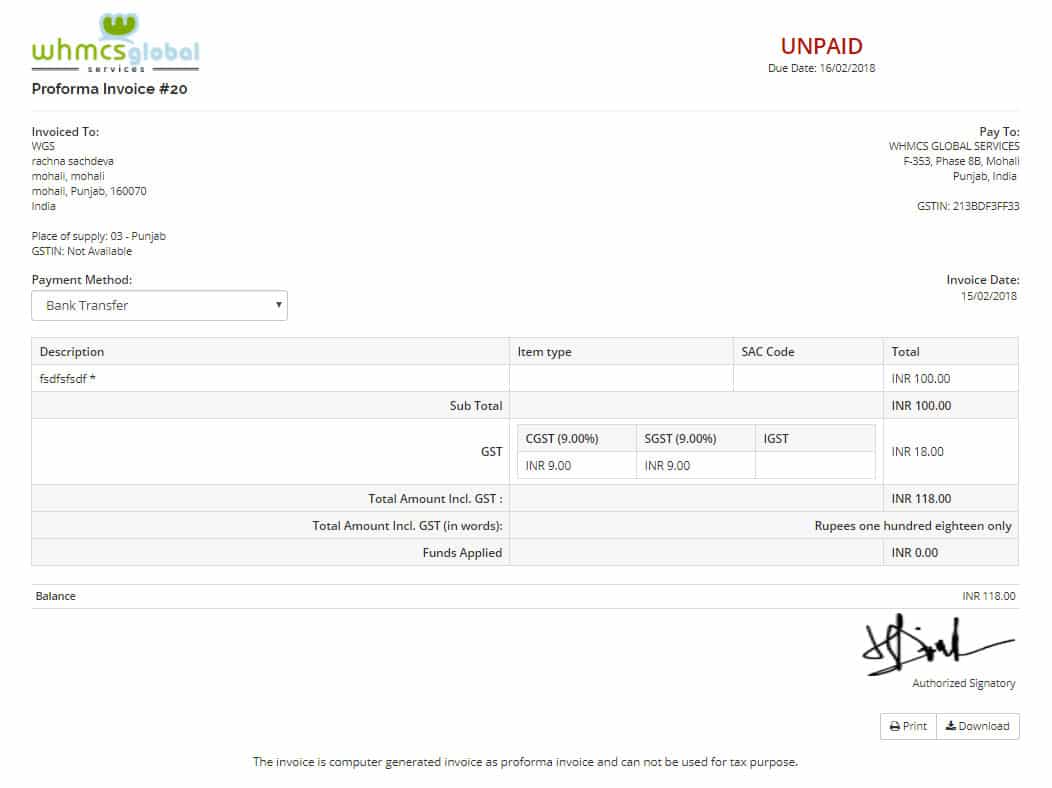

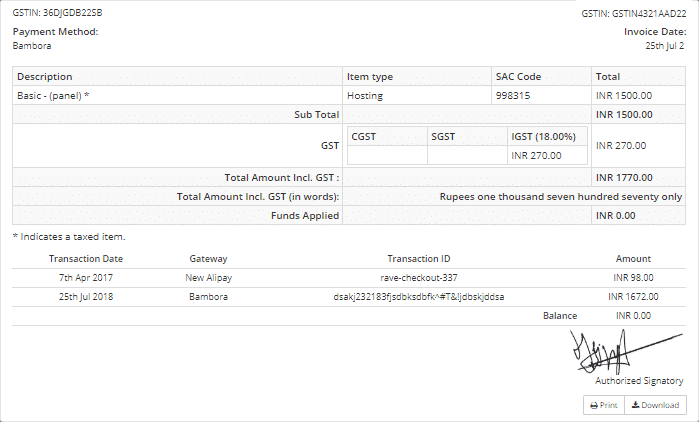

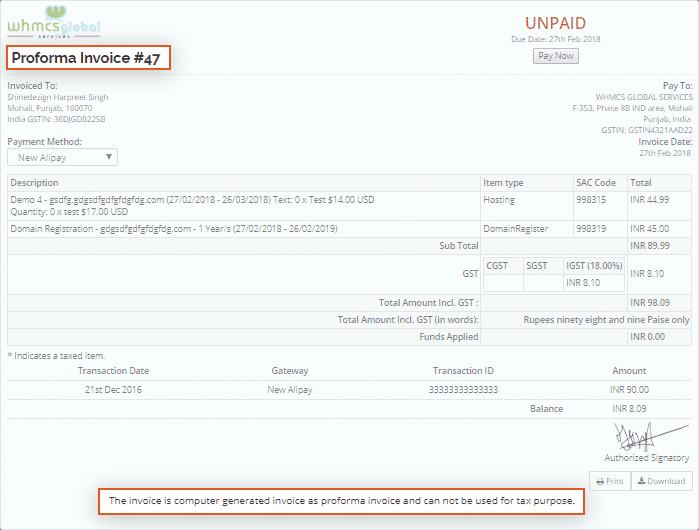

Invoice format

Our invoice format meets all the requirements of the GST module as it has all the things that are mandatory. For detailed information, you can view the format of the invoice in the screenshot section.

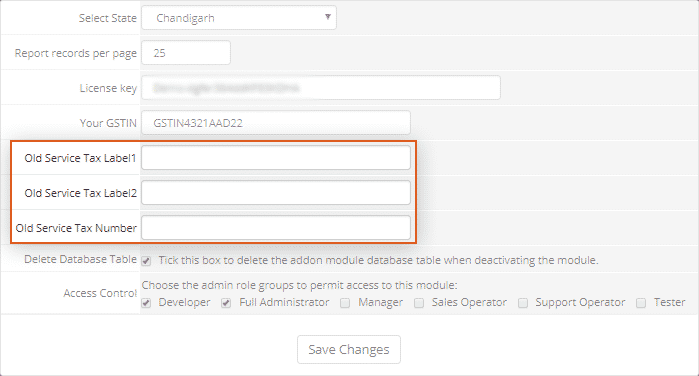

Old Tax labels

With this GST addon module, we have integrated an option to add your previous tax labels that will be applied on invoices before 1st July 2017, and on the latest invoices, it will be applicable as GST. You need to enter your previous tax labels in our addon configuration.

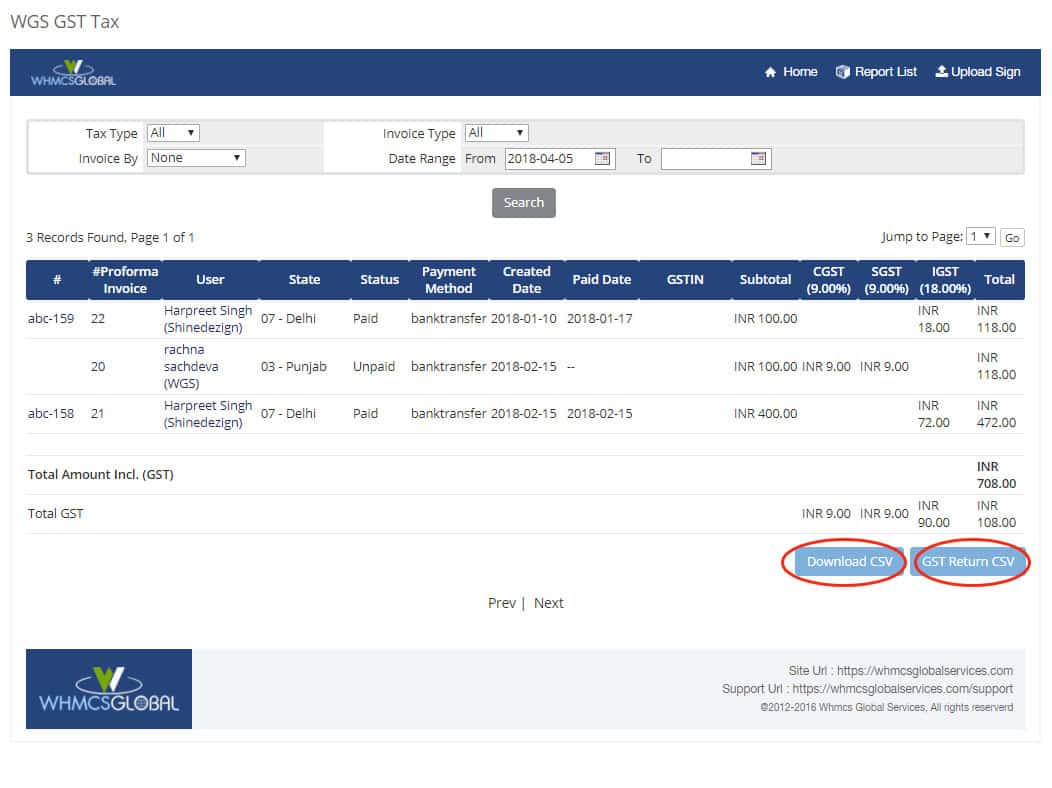

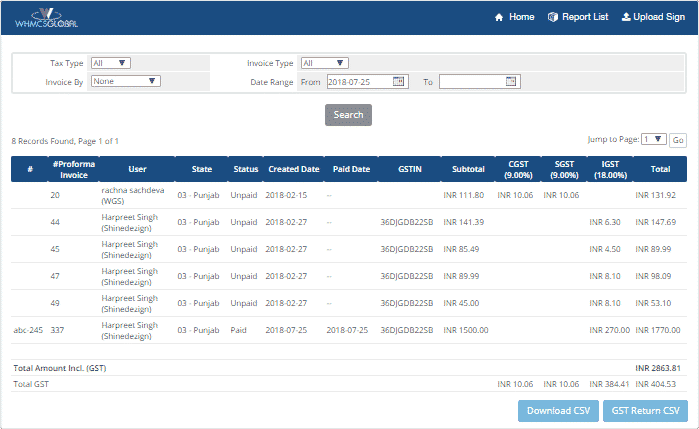

Report Section

All the transaction details as per GST will be shown under the report section and you can download it in CSV format. Moreover, this GST module allows you to apply basic filters like date range, tax type and invoice type as well.

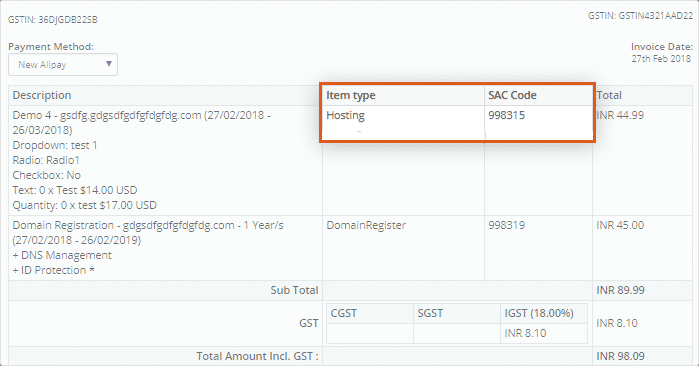

SAC codes

SAC codes are mandatory to have in your invoice for each product. They are added dynamically into invoice. For e.g., If user has ordered hosting service, then it will show SAC code specified for the hosting service and if Domain Registration then different SAC code and so on.

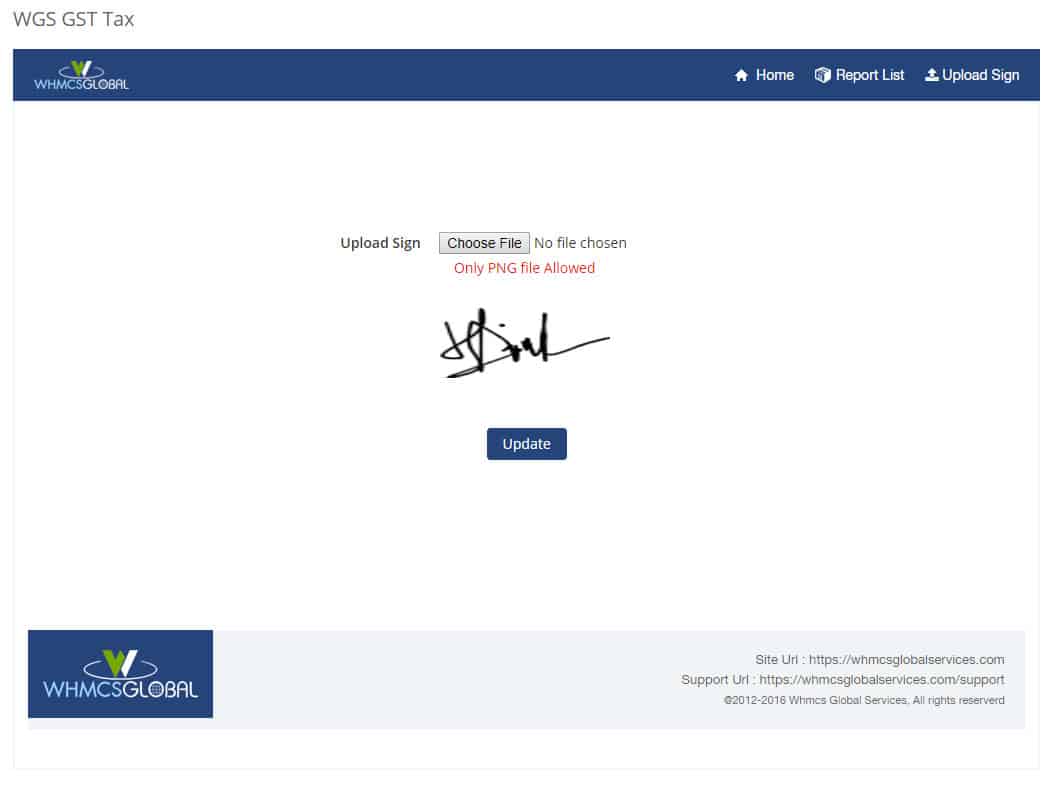

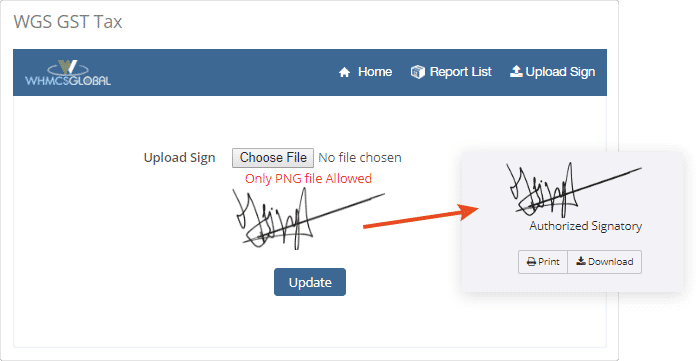

Add authorized signature on invoice

In addon there is an option to upload your signature image and that will be shown on all invoices.You can use a third party website like http://onlinesignature.com/draw-a-signature-online to create your signature and download image from there and upload it through our module.

Quote and Performa invoice

This GST module also allows you to add new quotes and perform invoices as per GST compliance.

A WHMCS GST module is a plugin or extension that is designed to help businesses manage GST compliance in their WHMCS installation. It may provide features such as automatic tax calculation, invoice generation, and reporting.

Whether or not you need to use a WHMCS GST module will depend on the tax laws in your country and your business needs. If you need to charge GST on your services, a WHMCS GST module can help simplify the process and ensure compliance.

Yes, most WHMCS GST modules will allow you to customize your tax settings to suit your business needs. This may include setting different tax rates for other products or services, applying tax exemptions, etc. Consult the module documentation or contact the developer for more information.