$299.00

$239.20

Order now

Free Module Updates

One-Click Upgrade

Access To Premium Offers

Multi-Level Tech Support

10 Days Money Back Guarantee

Development licence available for 30 Days on demand

$1199.00

$959.20

Order now

Module Overview

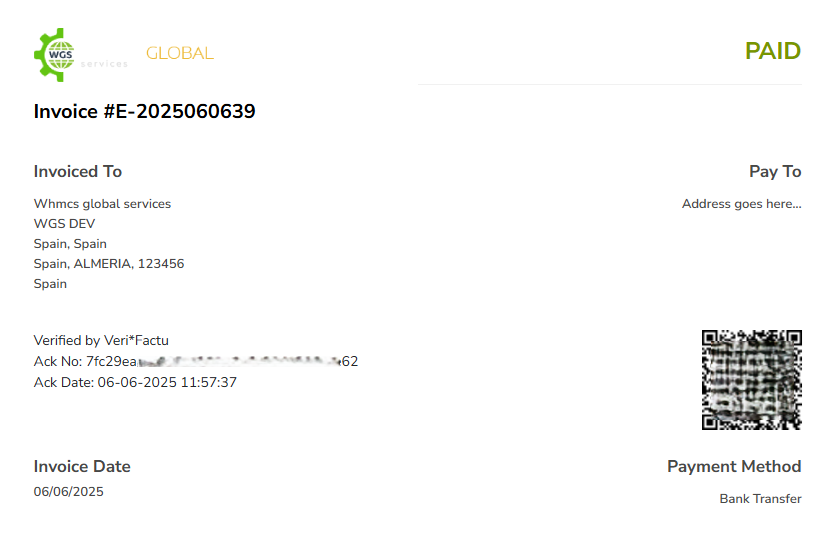

Managing tax compliance in Spain has become increasingly complex due to the country’s strict fiscal regulations and evolving e-invoicing mandates. If your business operates in Spain and you are using WHMCS, it’s now vital to comply with Verifactu, the country’s official antifraud law, or TicketBAI (Basque Country). Therefore, whether you are a hosting provider, SaaS company, or service-based business, our Spanish Fiscal E-Invoicing module ensures your Spanish operations are fully aligned with national tax regulations.

Key Features

Your questions, our answers

This module allows Spanish companies or self-employed workers to generate invoices according to the new anti-fraud regulations, TicketBAI and Verifactu, thanks to Fiskaly’s SIGN ES API.

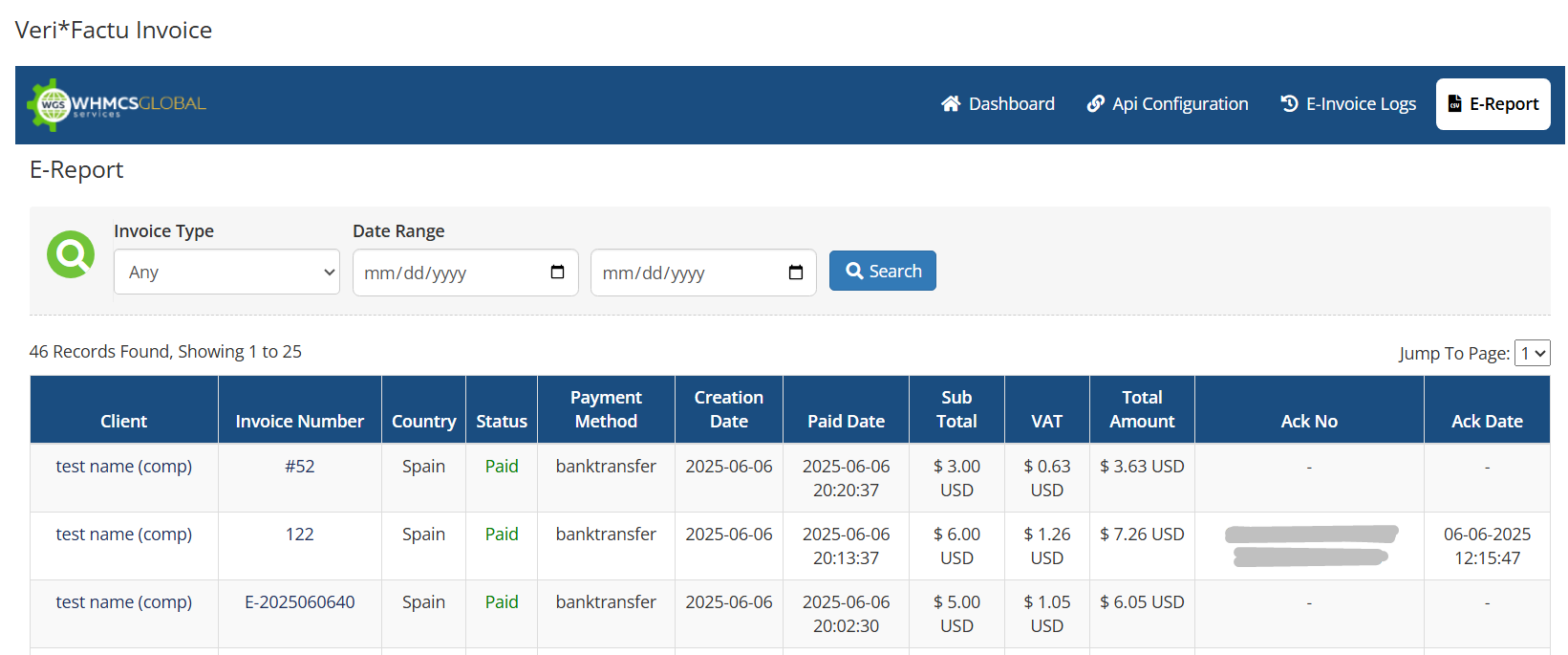

Supports XML exports, CSV reports, and full status tracking and invoice in WHMCS.

No, registration is not required. We are an official partner of Fiskaly’s we will help you all in terms of API & account setup etc.

API is not free. It will cost you €20 Euro per month and you will get 5000 signatures per month.

Yes, if your business is located in Spain and your yearly turnover is lower than 6 million a year, you need to comply with Verifactu. This module automates that process for you.

Not at all, the module only activates for clients whose country is set to “Spain “in WHMCS. It runs independently and doesn’t affect your invoicing for other countries.

The module allows compliance with both. Depending on the company’s tax domicile, this will be obliged to use one or the other (TicketBAI if the company is located in the Country Basque and Verifactu if it is located in the common territory).

Does the TicketBAI system include compliance in the 3 local treasuries, Bizkaia, Gipuzkoa and Alava?

Yes, Fiskaly is registered as a guarantor software in the three regional treasuries in the country.

Yes, You are supposed to register all them.

You can export invoice data in XML (for tax compliance) and CSV (for internal or accounting use).

Of course. The module uses token-based authentication and protocols (encrypted communication).

SIGN ES complies with 100% of the tax regulatory requirements. To protect the security and privacy of taxpayers’ tax

data, it adheres to strict technical and organizational security measures and is ISO 27001 and ISO 9001 certified.

Yes, the audit regulations in Spain cover both full invoices and simplified invoices (tickets), as well as other

commonly used invoices such as corrective invoices or exchange invoices.

The submission of invoices to the AEAT through the Verifactu systems has two deadlines:

January 1, 2026: Mandatory (entry date for companies and corporate tax payers).

July 1, 2026: Mandatory (entry date for all other businesses and self-employed workers).

Fiskaly, as a social partner of the AEAT, allows billing records to be submitted without the need to use the taxpayer’s digital certificate

Have more questions?

Our support team loves answering questions

If you are looking for an E-Invoice Fiscal WHMCS module for European countries such as Austria, Germany, or France, we can help. Contact us for custom module development to ensure full compliance with local tax regulations.